Blog

“Smart Property Solutions for Modern Shared Living”

Helping You Grow Your Super Through Secure, Cashflow-Positive Co-Living Investments

🌏 Latitude Property Escapes | Quarterly Property Investment Report – March 2025

Build Wealth. Escape the Ordinary. Retire with Latitude.

🧭 National Construction Trends | March 2025

Discover how strategic property types are evolving—and how savvy SMSF investors are staying ahead.

| Property Type | Average Build Cost per m² | 12-Month Increase |

|---|---|---|

| SDA (NDIS) | $2,864.03 | ↑ $58.99 |

| Rooming House | $2,693.65 | ↑ $201.55 |

| Dual Occupancy | $2,679.02 | ↑ $186.92 |

| Dual Key | $2,479.38 | ↑ $244.81 |

| Duplex | $2,592.02 | ↑ $198.65 |

| Terrace/Villas | $2,451.50 | ↑ $123.45 |

| Town House/Unit | $2,280.76 | ↑ $98.76 |

| Co-Living | $2,270.33 | ↑ $150.22 |

| House and Land | $2,221.92 | ↓ $5.36 |

| Display Home | $285.72 | ↑ $15.62 |

🚀 Latitude Insight: Costs are rising across nearly every property category—particularly those suited for dual income or disability support. Now is the time to act before further inflation eats into investor margins.

🏙️ Metro vs. Regional – Where’s the Smart Money Going?

| Property Type | Metro Build Cost per m² | Regional Build Cost per m² |

|---|---|---|

| Dual Key | $2,072.11 | $2,926.81 |

| Dual Occupancy | $2,307.17 | $2,814.62 |

| SDA (NDIS) | $2,892.88 | $2,807.45 |

🔍 Latitude Tip: Despite higher regional construction costs, investor demand is soaring—thanks to superior rental yields, government incentives, and fast-growing regional hubs.

🔑 SMSF Investment Insights – March 2025

At Latitude Property Escapes, we empower everyday Australians to unlock lifestyle, legacy, and long-term cash flow with premium, SMSF-qualified properties.

- ✅ Dual Income Strategies: Dual Key + Rooming Houses remain high-yield favourites

- ✅ SDA Investments: Rising costs = rising demand = rising rental returns

- ✅ Regional Escapes: Strong growth in areas like Ballarat, Toowoomba, and Central Coast

💼 "Smart investors aren't waiting for the market to settle—they're repositioning for growth inside their SMSFs." — Phil Allen, SMSF Strategist & Founder, Latitude Property

📈 What’s Ahead for Q2 2025?

- • Construction costs will likely continue rising—particularly in co-living and dual occupancy.

- • Government-backed SDA demand remains stable, with bipartisan support and increasing funding allocations.

- • Latitude's regional projects are gaining traction for both lifestyle-driven investors and SMSF strategists.

🏁 Next Steps with Latitude Property Escapes

If you’re ready to escape the ordinary and build a future with financial confidence, book your free 30-minute strategy session with Phil Allen and the Latitude team.

🎁 Special Offers for March–April 2025:

• Free SMSF Setup (save $2,350)

• 2 Years Free SMSF Accounting (save $3,000)

• Free Customised Investment Roadmap

How to Purchase Property in Your SMSF Using a Limited Recourse Loan

At Latitude Property Escapes, we believe that building your retirement wealth should be both strategic and empowering. One powerful strategy available to Self-Managed Super Fund (SMSF) trustees is purchasing investment property — even if your SMSF’s balance alone isn't quite enough.

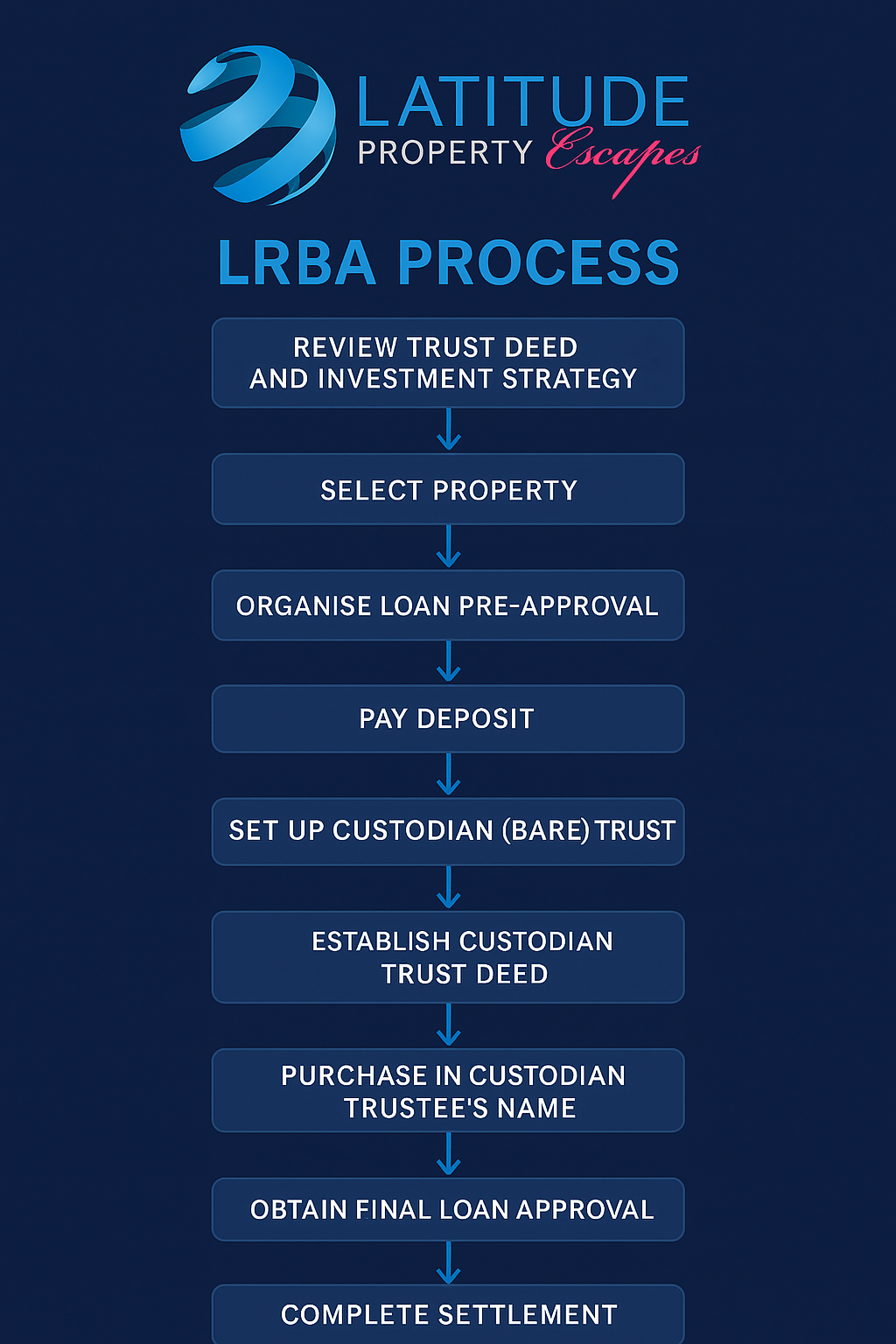

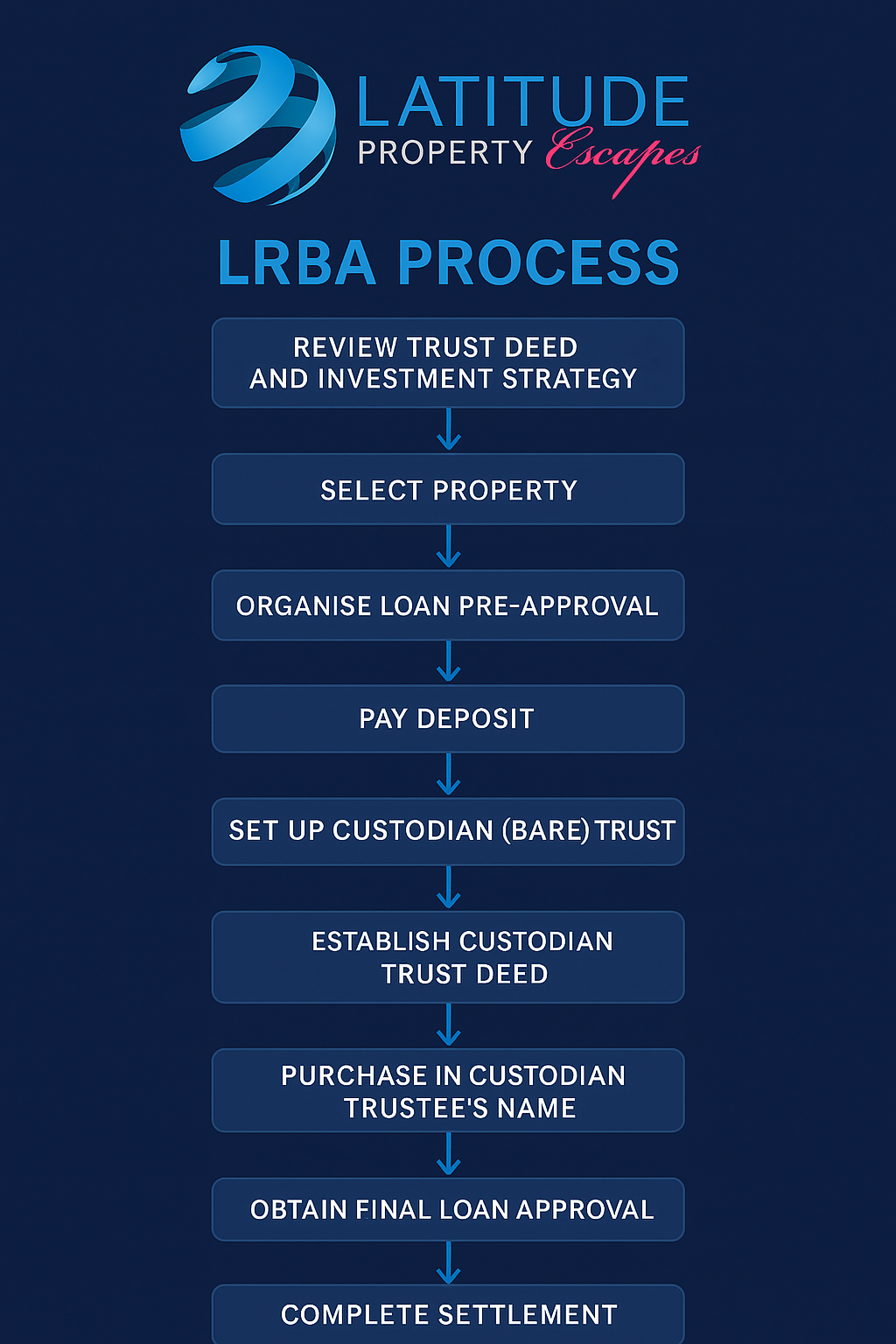

Step-by-Step Guide

Step-1: Review Your SMSF’s Trust Deed and Investment Strategy

Ensure your trust deed permits borrowing and aligns with your investment strategy. Consult an SMSF specialist accountant or planner.

Step-2: Select the Right Property

The property must pass the sole purpose test and not be used by or rented to related parties, unless it's business real property.

Step-3: Organise Loan Pre-Approval

Work with an SMSF-experienced finance broker. Expect up to 75% LVR, and your SMSF’s income strength will be reviewed.

Step-4: Pay a Deposit

SMSF trustee pays deposit (typically 10%). The trustee name must appear on all documentation.

Step-5: Set Up a Custodian (Bare) Trust

Create a new company to act as custodian. This company must only serve this property and be separate from your SMSF trustee.

Step-6: Establish the Custodian Trust Deed

Prepare and lodge the bare trust deed with the correct property details. Lodge with State Revenue Office if required.

Step-7: Purchase in the Custodian Trustee's Name

The property contract must name the custodian trustee as the buyer, not the SMSF.

Step-8: Obtain Final Loan Approval

Formal loan documents are signed and returned after full structure and property verification.

Step-9: Complete Settlement

Loan funds and SMSF contribution finalise the settlement. SMSF holds beneficial ownership; legal title remains with the custodian until repaid.

Understanding the Power (and Rules) Behind an LRBA

- Only the purchased property is lender security — not other SMSF assets.

- Property must be held in a bare trust until the loan is repaid.

- Can only be used for one acquirable asset per arrangement.

Key Property Eligibility Rules

- Must pass the sole purpose test for retirement benefits.

- Cannot be bought from or rented to related parties (unless business property).

- Cannot be used or occupied by SMSF members or relatives.

Why Choose Latitude Property Escapes?

We specialise in helping Australians use their SMSFs to unlock wealth through smart property investment. From property selection, finance brokering, and trust structuring to compliance — we’re your one-stop-shop.

Borrowing inside your SMSF can be powerful — and with Latitude, it's done right.

How to Purchase Property in Your SMSF Using a Limited Recourse Loan

At Latitude Property Escapes, we believe that building your retirement wealth should be both strategic and empowering. One powerful strategy available to Self-Managed Super Fund (SMSF) trustees is purchasing investment property — even if your SMSF’s balance alone isn't quite enough.

Step-by-Step Guide

Step-1: Review Your SMSF’s Trust Deed and Investment Strategy

Ensure your trust deed permits borrowing and aligns with your investment strategy. Consult an SMSF specialist accountant or planner.

Step-2: Select the Right Property

The property must pass the sole purpose test and not be used by or rented to related parties, unless it's business real property.

Step-3: Organise Loan Pre-Approval

Work with an SMSF-experienced finance broker. Expect up to 75% LVR, and your SMSF’s income strength will be reviewed.

Step-4: Pay a Deposit

SMSF trustee pays deposit (typically 10%). The trustee name must appear on all documentation.

Step-5: Set Up a Custodian (Bare) Trust

Create a new company to act as custodian. This company must only serve this property and be separate from your SMSF trustee.

Step-6: Establish the Custodian Trust Deed

Prepare and lodge the bare trust deed with the correct property details. Lodge with State Revenue Office if required.

Step-7: Purchase in the Custodian Trustee's Name

The property contract must name the custodian trustee as the buyer, not the SMSF.

Step-8: Obtain Final Loan Approval

Formal loan documents are signed and returned after full structure and property verification.

Step-9: Complete Settlement

Loan funds and SMSF contribution finalise the settlement. SMSF holds beneficial ownership; legal title remains with the custodian until repaid.

Understanding the Power (and Rules) Behind an LRBA

- Only the purchased property is lender security — not other SMSF assets.

- Property must be held in a bare trust until the loan is repaid.

- Can only be used for one acquirable asset per arrangement.

Key Property Eligibility Rules

- Must pass the sole purpose test for retirement benefits.

- Cannot be bought from or rented to related parties (unless business property).

- Cannot be used or occupied by SMSF members or relatives.

Why Choose Latitude Property Escapes?

We specialise in helping Australians use their SMSFs to unlock wealth through smart property investment. From property selection, finance brokering, and trust structuring to compliance — we’re your one-stop-shop.

Borrowing inside your SMSF can be powerful — and with Latitude, it's done right.

LRBA Process | Latitude Property Escapes

LRBA Process

LRBA Process